Attention Ticket Resellers: Uncle Sam Says The Party is Over

|

| Photo: KRON4.com; Ticketmaster |

Uncle Sam (Govt. Name: IRS) is saying the party is over to people who make their living hoarding concert or sporting event tickets and reselling them online.

Resellers this year will be scrutinized by Uncle Sammy (IRS) when they file their taxes as a new law has been implemented that takes effect this tax year. The new law lowered the tax reporting threshold for users of e-commerce platforms including Ticketmaster and Stub Hub. According to Fox Business, “The IRS is requiring these types of platforms to provide info on sellers’ proceeds to the IRS if their ticket sales are more than $600 in one year (previously the threshold was $20,000 in revenue and more than 200 transactions). The new change to the threshold will be triggered with just one transaction if it goes over $600 limit.”

So what does all this mean? Ticketing platforms will now be required to report sellers’ proceeds of $600 or more over the course of a year and send them a 1099-K form. A 1099-K form is used to report payments from online sales of more than $600 – whether or not a profit was made.

For people whose side hustle is to buy a bunch of concert tickets and then resell them on Etsy, Ebay, FB Marketplace, Venmo or whatever online marketplace platform they use – expect Uncle Sam to come knocking on your door to make sure you’re reporting it on your annual taxes.

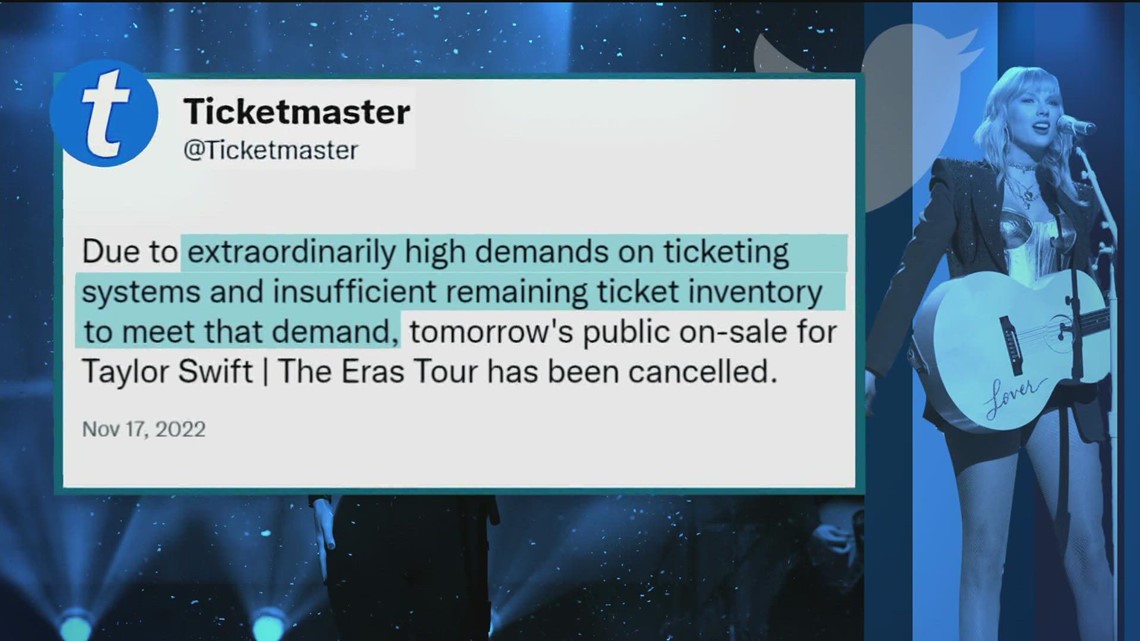

While the practice of hoarding concert tickets and reselling them has been going on since the dark ages, it grabbed the attention of the government last year when tickets to Tay-Tay Eras tour went on presale. It caused millions of Swifties to get pissed off since they were unable to access Ticketmaster’s website because resellers were buying up tickets. The same thing happened to Beyonce and her beyhive minions, Harry Styles, and even Lionel Messi when word got out he was going to play for Miami soccer team.

|

| Photo: Ticketmaster, 2022 |

BTW, this new law also impacts payments for items or services anyone sells at online marketplaces. So if you’re planning to sell your used futon on FB Marketplace, crafts on Etsy, or your priceless collection of Betamax tapes on Ebay and if your total annual sales of stuff or services you sell using an online marketplace = $600 or more, expect to receive a 1099-K form from your payment processor. The IRS isn’t screwing around anymore. In the past, many resellers from all walks of life made a shitload of money selling stuff online and didn’t bother to report it. Game over.

|

| Photo: Legal Templates.com |

Source: Fox Business News; Gizmodo

Comments

Post a Comment